Three Estate Planning Documents Every College Student Needs

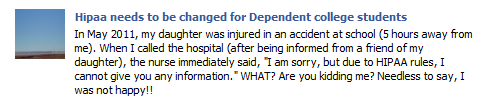

The image above came from an actual Facebook page I found. An irate mother started the page after a nurse refused to provide her with information about her daughter who was injured in a car accident while five hours away at school.

Adult Children Have Privacy Protections

It brings up an issue about which many parents sending their children off to college this fall are not aware. You may be paying your child’s college tuition and expenses, and covering him or her on your health insurance. But in the eyes of the law, your 18-year-old is legally an adult and entitled to the same privacy protections that you are.

This means that even though your child may be relying on you for the majority of his or her support, privacy laws prohibit financial institutions and medical providers from disclosing private information concerning your child to you without his or her authorization.

Under normal circumstances, this may not be a problem. Parents of college students should encourage their kids to be self-reliant and financially responsible. Being away from home gives them an opportunity to experience life as an adult for the first time. And encouraging independence is a good thing.

But what happens in case of an emergency? Will you be able to access information about your child’s condition if your child is seriously ill or injured while away at school? Will you be able to help them handle their financial affairs if they are incapacitated and unable to make these decisions on their own?

Estate Planning Documents College Students Need

Without three important documents, you may not be able to step in when your child needs you most. That’s why you should encourage your college student to get the following documents before heading off to school:

- Durable Power of Attorney: The Durable Power of Attorney will allow your child to authorize you to manage his financial affairs either immediately or in the future should he become mentally or physically unable to do so. This would authorize you to handle tasks such as paying bills, applying for social security or government benefits and opening and closing accounts if necessary.

- Health Care or Medical Power of Attorney: A Health Care or Medical Power of Attorney allows your child to authorize you to make medical decisions if he or she is incapacitated. An agent acting under a Medical Power of Attorney is authorized to see the principal’s medical records to make informed medical decisions on his or her behalf.

- HIPAA Release: HIPAA (the Health Insurance Portability and Accountability Act of 1996) requires health care providers and insurance companies to protect the privacy of patient’s health care information. Those who violate HIPAA are subject to civil and criminal penalties, including jail time. This makes them reluctant to share protected health information without an authorization. While it’s true an agent under a Medical Power of Attorney has the authority to view the principal’s medical records, the Medical Power of Attorney does not grant authority to the agent until the principal is incapacitated. If capacity is questioned, then HIPAA regulations would prevent access to protected health information. This means that even parents may be prevented from accessing their children’s medical information without an authorization. By signing a HIPPA release your child can authorize doctors to share diagnoses and treatment options with you.

These three documents are easy to prepare and relatively inexpensive. If you have children going to college this year, discuss the importance of these documents with them.

This article was originally published on August 8, 2011, and updated on August 8, 2022.

Comments

3 Critical Planning Documents for College Students | Grand Rapids, Michigan Wills, Trusts and Estate Lawyer | Lichterman Law, PLC

August 14, 2011 at 4:54pm

[…] blog posts in the national media as well as those by colleagues of mine. I recently ran across this terrific post by my colleague Rania Combs. If the name sound familiar, it should. This isn’t the […]

Preparing for Emergencies – Legal Documents for Your College Student « David McDaniel's Blawg

August 16, 2011 at 10:56am

[…] came across this blog post from Rania Combs. While I – and other estate planning attorneys – typically focus […]

College Parent News and Views — College Parent Central

September 9, 2011 at 7:20pm

[…] Three Documents Every College Student Needs […]

Ellen Oshiro

August 18, 2012 at 4:21pm

Question: Does this apply if your college-attending kids live with or near you? This article emphasizes kids who away at college. Should all adult/college-attending kids have these documents in place?

Rania Combs

August 20, 2012 at 9:21am

All college-attending children should have these documents in place, even those who attend college nearby.

Estate Planning Documents For College Students – Texas Wills & Trusts

October 2, 2013 at 3:13pm

[…] A couple of years ago, I wrote blog post titled “Three Estate Planning Documents Every College Student Needs.” […]

Mary

May 15, 2017 at 2:44am

In my opinion, every child should sign these legal documents on their 18th birthday (or soon after). Even when they’re still in high school. The day they turn 18, your access to their health care info & possibly even ability to make medical decisions is gone unless they’ve signed documents. I’ve also heard it’s a good idea for kids 18 and over to designate beneficiaries on any bank accounts.

Rania Combs

May 16, 2017 at 3:12pm

I agree, Mary! Thanks for your comment.

Beth Agin

August 3, 2018 at 12:33pm

Can I receive these forms from you for a fee?

We live in Cincinnati, OH.

I have found a variety of them from the internet, but would like clear, clean unified forms for use.

thanks! -beth

Rania Combs

August 10, 2018 at 5:55pm

Each state has state-specific documents. You should contact an attorney licensed in your state for assistance.