Texas Small Estate Affidavit: Eligibility, Filing Process & Requirements

A Small Estate Affidavit can be a quick and cost-effective way to transfer property to a decedents legal heirs without going through formal probate in Texas when someone dies without a Valid Will in Texas but has very little in terms of probate assets.

They may have owned a modest home, and had a small checking and savings account, but nothing more. In such situations, probate seems like overkill. Their loved ones often ask: “Is there an easier way? This guide explains when a Small Estate Affidavit is applicable, what the filing process looks like, and how to get started.

Who are a Decedent’s Legal Heirs

In the absence of a valid Will, the Texas intestacy statutes control who will inherit a decedent’s property. Generally, these heirs include the surviving spouse, children, and in some cases, parents or other extended family members, depending on the family structure. While intestacy laws provide a default plan for distribution, writing a valid Texas Will would allow the decedent to specify exactly who should inherit their property, rather than relying on the state’s default rules.

What Estates Qualify for a Small Estate Affidavit in Texas?

In Texas, an estate can qualify for a small estate affidavit to transfer property without a formal probate when:

- The deceased person died without a valid Will;

- At least 30 days have passed since the date of death;

- No person has filed an application seeking appointment as personal representative of the estate;

- The value of the probate estate is $75,000 or less, excluding the value of the homestead and other exempt property; and

- The total assets exceed known debts (excluding homestead and exempt assets).

How to Determine if an Estate Qualifies for a Small Estate Affidavit?

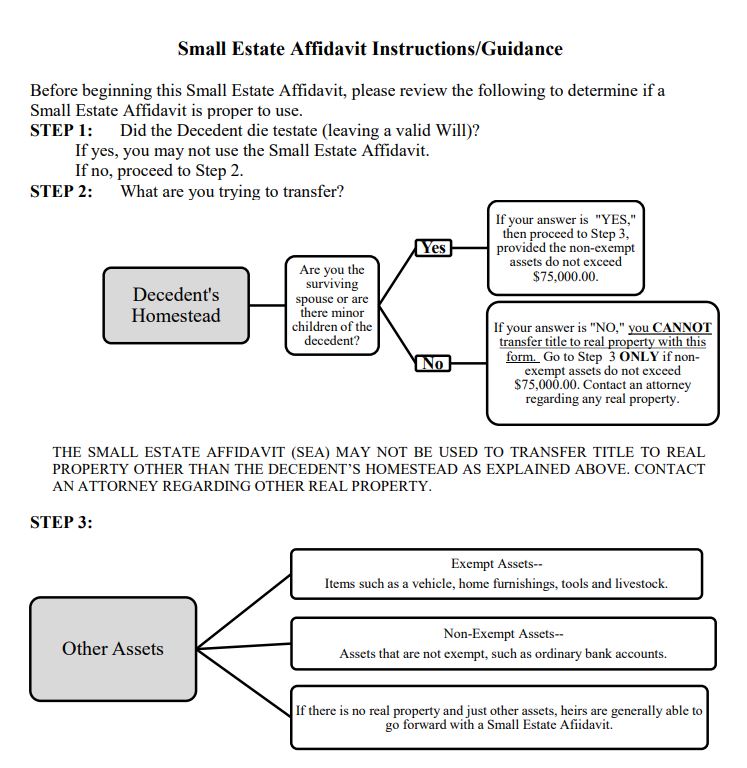

If you’re unsure whether your estate qualifies for a Small Estate Affidavit, the Harris County Clerk’s Office provides a helpful flowchart that guides Texans through the decision-making process. The flowchart breaks down the eligibility criteria and helps you assess whether the estate meets the necessary requirements.

If the estate meets these requirements, the heirs can file a Small Estate Affidavit to avoid the need for formal probate, making the process more efficient and less expensive.

What are Exempt Assets in Texas?

Certain assets are exempt from the $75,000 limit. These include:

- Homestead property for the benefit of the surviving spouse or minor children.

- Personal property such as household items, jewelry, vehicles, livestock, and pets (up to $100,000 for married decedents and $50,000 for single decedents).

These assets do not count toward the total estate value for Small Estate Affidavit eligibility.

Where Can I find a List of Exempt Personal Property in Texas?

A list of exempt property can be found in Section 42.001 of the Texas Property Code. These exemptions help ensure that essential property—such as a family home or necessary personal items—remains protected. Some examples of exempt personal property include:

- Home furnishings, including family heirlooms

- Food and provisions for consumption

- Farming or ranching implements and vehicles

- Tools, equipment, books, and apparatus including boats and motor vehicles used in a trade or profession

- Clothes

- Jewelry in an amount that does not exceed 25% of the $100,000 and $50,000 limits mentioned above

- Two firearms

- Athletic and sporting equipment, including bicycles

- Vehicles for each member of a family or single adult who holds a driver’s license (or relies on someone else with a license

- Certain livestock (two horses, mules, or donkeys with a saddle, blanket, and bridle for each, 12 head of cattle, 60 head of other livestock, 120 fowl

- Household pets

Pension benefits, retirement assets and insurance benefits are also exempt.

Can I Use a Small Estate Affidavit to Transfer Real Estate in Texas?

Typically, real property cannot be transferred using a Small Estate Affidavit, unless the property is the decedent’s homestead and the decedent is survived by a spouse or minor children who lived on the property.

For any other type of real estate, such as rental properties or investment properties, the formal probate process may be required.

Estate vs. Probate Estate

Note that the $75,000 limit pertains only to the value of a decedent’s probate estate, not the gross estate. The probate estate consists of property titled in the decedent’s name, excluding value of the homestead. It does not include assets placed in trust. It also does not include assets that transfer by payable-on-death accounts, transfer on death designation, or beneficiary designation.

So suppose a decedent had a $500,000 life insurance policy and a $300,000 retirement plan. If he named has wife has the beneficiary, and the value of his remaining assets, excluding his homestead, do not exceed $75,000, his estate might still qualify for small estate administration.

What Must Be Included in a Small Estate Affidavit?

To be valid, a Small Estate Affidavit must contain specific information to ensure compliance with Texas law. Here are the key components that must be included:

- List of Assets and Liabilities: The affidavit must list all known estate assets (such as bank accounts, vehicles, and personal property) and any liabilities (debts) in the probate estate. It is crucial that this list be complete and accurate.

- Names and Addresses of Heirs: The affidavit must include the names, addresses, and relationships of all heirs to the deceased. This section also outlines how each heir is entitled to a portion of the estate based on Texas intestacy laws.

- Family History and Legal Capacity: The affidavit must explain the family history of the deceased, detailing the relationships of the heirs. If there are minor heirs or incapacitated individuals, the affidavit must include their natural guardians or next of kin.

- Affidavit of Disinterested Witnesses: The affidavit must be signed by two disinterested witnesses. These are individuals who have no personal interest in the estate and can verify the details provided in the affidavit.

- Signatures of Heirs: All heirs who are legally competent must sign the affidavit. Additionally, if there are minor or incapacitated heirs, their natural guardians or next of kin must also sign.

- Court Filing: Once the affidavit is complete and signed, it must be filed with the probate court for review. The court will determine if it meets all statutory requirements. If the court approves the affidavit, it becomes an official legal document, allowing heirs to collect assets and settle the estate.

The affidavit acts as a formal declaration that the estate’s assets can be distributed without undergoing the full probate process.

Do I need a Lawyer to File a Small Estate Affidavit?

No. You are not required to hire a lawyer to file a Small Estate Affidavit in Texas. Many probate courts offer downloadable forms and clear instructions for filing. For example, Harris County provides a very good small estate affidavit form (pdf), as well as detailed instructions for filling it out.

While it is possible to file the affidavit without legal assistance, it may be beneficial to consult an attorney if the estate involves complex assets or disputes.

Cost of Filing a Small Estate Affidavit

Filing fees for a Small Estate Affidavit vary by county. To determine the cost, contact the county clerk’s office where the decedent resided.

Is a Small Estate Affidavit Right for You?

A Small Estate Affidavit can be an efficient way to transfer assets without a formal probate, as long as the estate meets the required criteria. If you are unsure whether this option is right for you, an experienced Texas estate planning lawyer can help you make the best decision for your situation.

This article was originally published on March 3, 2017, and updated on January 30, 2025

Comments

Cheryl Woods

December 26, 2017 at 11:26am

My father passed on in 2002. My 84 year old mother has been diagnosed with dementia and has no will. Can she legally complete one now, or even make one of her five children the executor of her estate. She has five children and an extensive amount of property.

Rania Combs

December 31, 2017 at 2:37pm

In order to sign a Will, a testator must have testamentary capacity, which means that the testator have the mental ability to understand: the business in which he/she is engaged, the effect of making a will, the nature and extent of his/her property; the persons who are the natural objects of the testator’s bounty; the fact that he/she is disposing assets; and how all these elements relate so as to form an orderly plan for the disposition of the testator’s property.

Annette Rosas

February 18, 2019 at 11:52am

My mother recently passed away with no will she isn’t married and had only my brother and I. Currently I live in her home as I moved in about 6 months ago to take care of her. She basically has her home and car. What would I need to file and/or do?

Thank you

Rania Combs

February 19, 2019 at 12:54pm

I’m sorry for your loss. The Texas Young Lawyer’s Association has a publication that may answer many of your questions: The Texas Probate Passport.