‘Tis the Season for Scams

A man who introduced himself as Alex called last week. I was on another call, so I let the call go to my voicemail. He didn’t leave a message but kept calling back. When my call ended, I answered the phone. I heard the tail end of a recording indicating that the call was being recorded.

“This is Alex from Norton Securities and I am calling to verify your subscription and confirm that we will be renewing it at a cost of $2,000, which will be non-refundable unless you cancel it in the next 30 minutes.”

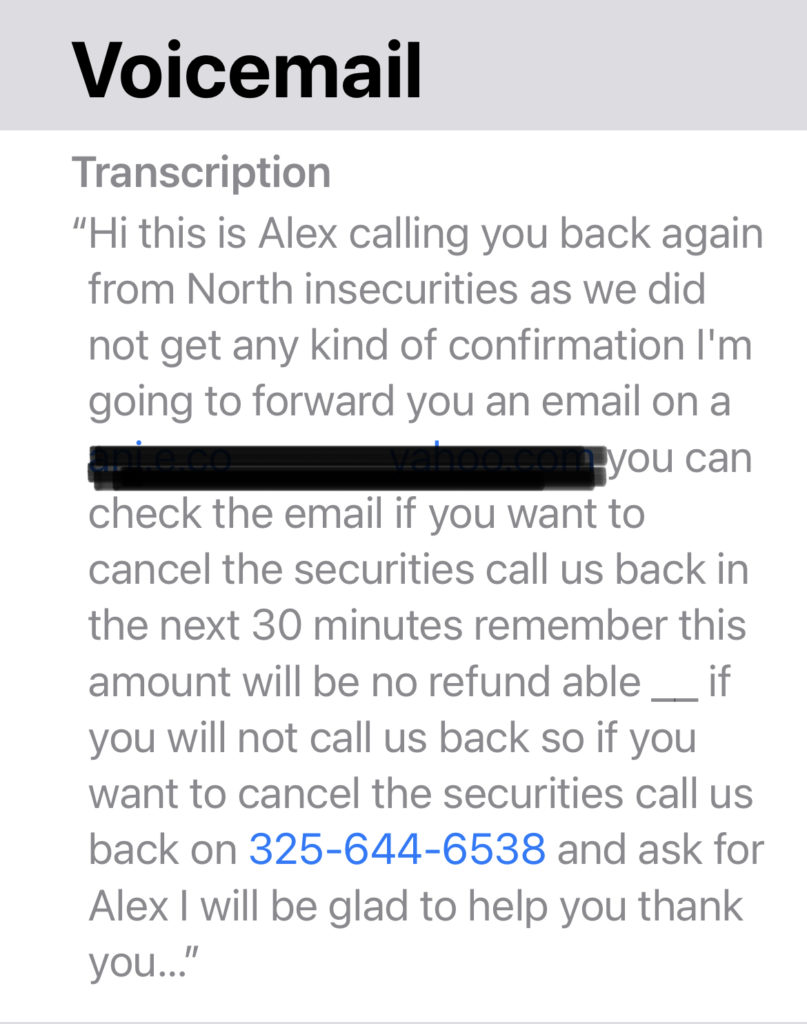

“I do not have a subscription” I replied. “Please take me off your list.” I hung up, but he persisted. He called back no fewer than four times, trying to get me to acknowledge a subscription and trying to scare me into thinking I needed to cancel it to avoid a non-refundable charge. When I resisted, he became argumentative and combative. Frustrated, I hung up again. Finally, he called back and left the following message.

I must admit that even though my brain told me it was likely a phishing attempt, I was nervous. I checked my financial accounts that evening to confirm there had not been any unauthorized charges. And I filed a complaint with the state attorney general’s consumer protection division, and the federal trade commission, giving as much information as I could so that authorities could hopefully take action against these fraudsters.

Four Common Signs of a Scam

It seems like scammers step up their efforts during the holiday season, so it’s important to be vigilant. According to the FTC, scams have four common signs:

- Scammers pretend to be from an organization you know. In my case, the scammer pretended he was from “Norton Securities.” Fortunately, I noticed the variation in the name — it’s actually Norton Security — and I knew for a fact that I did not subscribe to their product.

- Scammers say there’s a problem or a prize. In my case, they wanted me to acknowledge that I had a subscription they would renew unless I actively canceled it.

- Scammers pressure you to act immediately. Alex told me that if I did not decline the subscription within 30 minutes there would be a non-refundable charge of $2,000.

- Scammers tell you to pay in a specific way.

Tips to Avoid Being Victimized

To avoid being a victim of a scam, don’t give personal or financial information in response to a request you didn’t expect. Even though they apply pressure for you to act immediately, resist the temptation. Anyone who attempts to pressure you into taking action immediately is likely a scammer. Additionally, don’t use payment methods that don’t have any fraud protection, such as gift cards, wire transfer services, or cryptocurrency. And if you’re concerned, talk to someone you trust about what happened before taking any action because talking about it may help you realize it is a scam.

Finally, if someone attempts to scam you, or you become a victim of a scam, submit reports to the FBI’s Internet Crime Complaint Center (IC3) at ic3.gov and the Federal Trade Commission at reportfraud.ftc.gov.

Wishing you all a safe, happy, and scam-free Holiday Season!

Comments